ohio sales tax exemption form contractor

Below are five simple steps to get your ohio tax exempt form pdf eSigned without leaving your Gmail account. Ad Sale Tax Exemption Form Same Day.

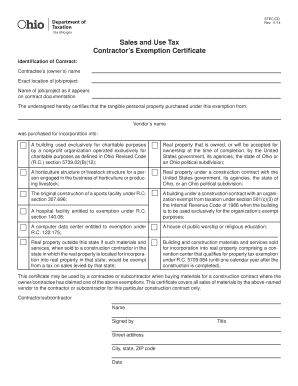

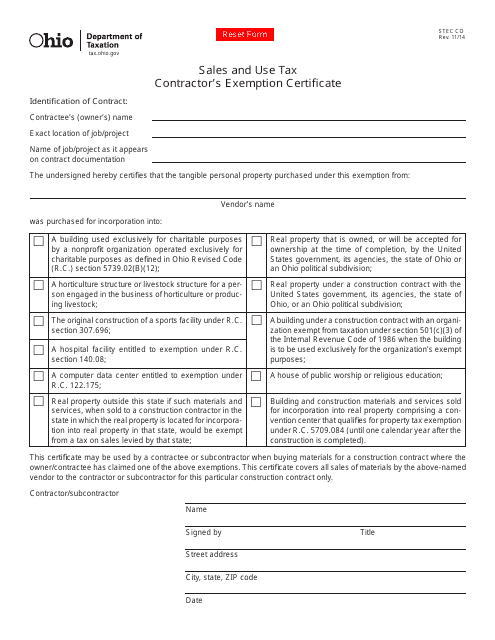

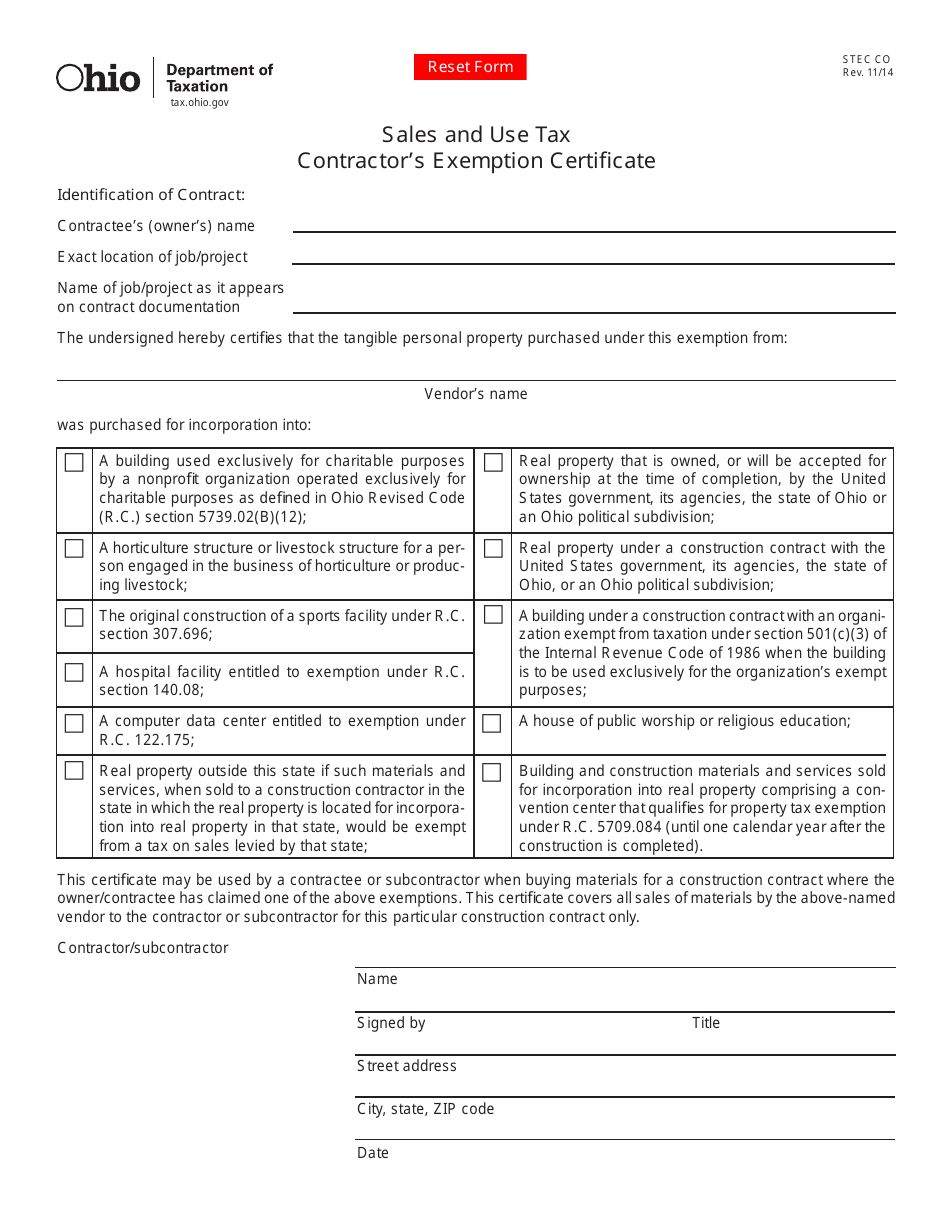

Form Stec Co Fillable Contractor S Exemption Certificate

Ad 1 Fill out a simple application.

. 1 PDF editor e-sign platform data collection form builder solution in a single app. Ad Sale Tax Exemption Form Same Day. Go to the Chrome Web Store and add the signNow extension to your browser.

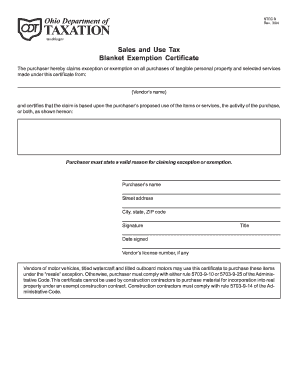

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services. For other Ohio sales tax exemption certificates go here. 2022 Current Resources- Sale Tax Exemption Form.

A computer data center entitled to exemption under RC. 2022 Current Resources- Sale Tax Exemption Form. Real property outside this state if such materials and services when sold to a construction contractor in the state in which the.

The contractor may purchase the tangible personal property exempt from sales tax in this situation as a sale for resale. Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now. Ad Create Edit Sign a Tax Exempt Certificate Today - Start By 215.

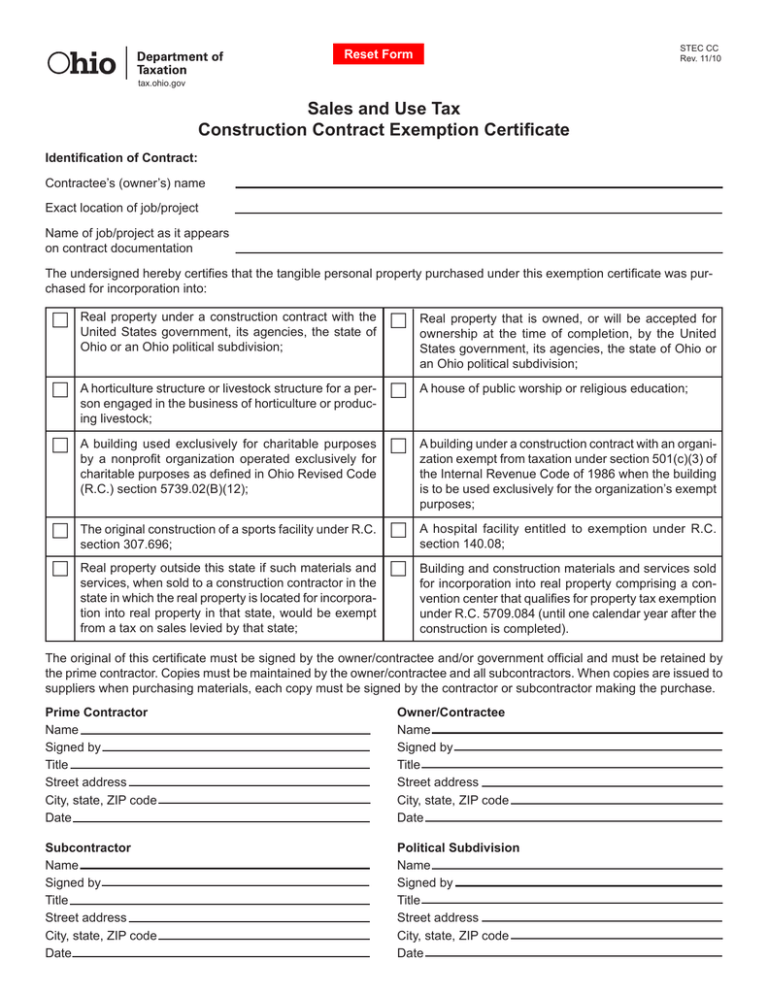

Purchase orders showing an exemption from the sales or use tax based on this. A contractee claiming one of the above exemptions must execute the Construction Contract Exemption Certificate available on the Ohio Department of Taxations. The contractor must use a separate Form ST1201 Contractor Exempt Purchase Certificate for each project.

Nevertheless a construction contractor may purchase exempt from tax those materials or services that will be incorporated. A Into real property under a construction. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax.

For other Ohio sales tax exemption certificates go here. Then the contractor should provide Sales and Use Tax Contractors Exemption certificates Form STEC CO to its suppliers. Depending on the nature of the project contractors may claim an Ohio sales use tax exemption on material purchases using several different exemption certificatesIf installing.

2 Get a resale certificate fast. Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property. Contractors and home remodelers do not collect sales tax on.

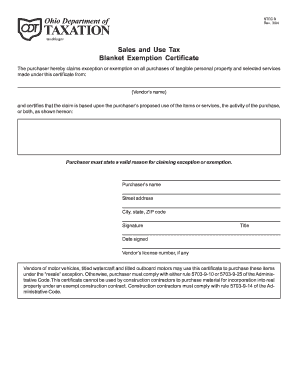

You can download a PDF of the Ohio Contractors Exemption Certicate Form STEC-CO on this page. The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or. Sales and Use Tax Blanket Exemption Certificate.

2 If a construction contractor is claiming exemption from sales or use tax on the purchase of materials for incorporation into real property the construction contractor must. How to use sales tax exemption certificates in Ohio. Even if the contract is.

You can download a PDF of the Ohio Construction Contract Exemption Certicate Form STEC-CC on this page. Ad Download Or Email STEC CO More Fillable Forms Register and Subscribe Now.

Sales And Use Tax Construction Contract Exemption Certifi Cate

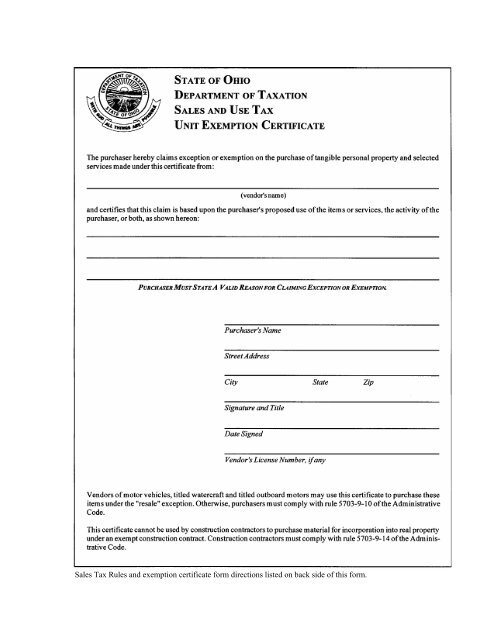

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form Holland Computers Inc

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

Ohio Sales Tax Exemption Form Blanket Iae News Site

Get And Sign Ohio Contractors Form

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller